Happy day! Welcome to our ATC video today. We are going to discuss the topic of nothing. I am a knowledgeable man, except when it comes to the certified list of employees who qualify for substituted filing. They should also be aware of the carting withholding tax on compensation. In our video, we will cover math videos and how to live for even less. This is not related to the tax compensation topic. However, it is necessary for the preparation and submission of the qualified stock for the certified list of employees who qualify for substituted filing. So, my employees, remember that you are nothing without tax compensation. It is essential for all employees, whether they are minimum wage earners or not, to comply with the auditing of taxes and compensation. Welcome to our ATC video today, part two, where we will discuss how to prepare and submit your certified employees for substituted filing. In part three, we will cover the topic of not being qualified for substituted filing. This means that you would need to file an annual ITR, which comes with penalties and surcharges if not done correctly or on time. Part four of our video will focus on how to prepare and submit your certified deeds of employees qualified for substituted filing. We will reference non-revenue regulation in urban 2018. Regardless of your employees' status as minimum wage earners or their withholding tax on companies, it is important to pass an item certification. Otherwise, you will be considered unqualified for substituted filing. In our final video, we will summarize the importance of the tax compliance and withholding tax on compensation. This will include monthly returns and ensure accuracy in reporting for all wage earners. Remember to deduct all expenses for income tax purposes.

Award-winning PDF software

1902 bir 2025 Form: What You Should Know

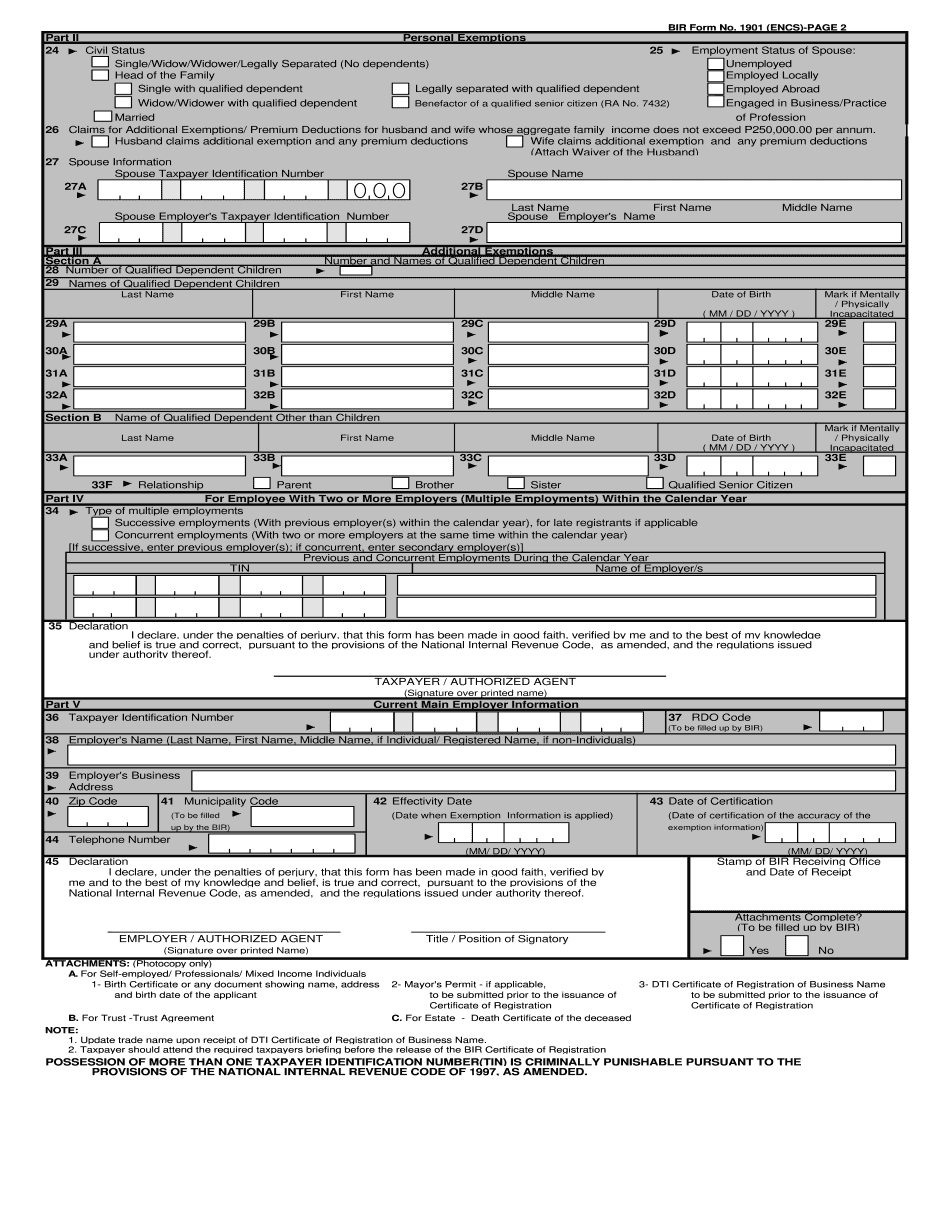

To include any other type of income. BIR-Form-1902.pdf BIR Form No. 1902. January 2025 (ENDS). For Individuals Energetically Engaged with a Performing Arts Group. BIR-Form-1902.pdf How can I register for the Income Tax? A. You may use the online option for individuals. Qty of Taxpayer: 4 You will pay an annual 25 fee and a 10.00 penalty. In addition, the IRS assesses a 3.5% annual levy on your account, effective July 1, 2018. Qty of Taxpayer: 4 A. You will not be charged any other fees. Qty of Taxpayer: 2 Fulfill the registration instructions in the application for each individual. Each filing year, BIR must have a copy of your application before you are eligible for an assessment. B. If you are a resident of Colorado, a Colorado resident will register under section A of this form. If that is you, you must fill out all the required information and submit the forms in 3 separate sections. You may submit the forms to BIR using the U.S. Postal Service or to file electronically. Qty of Taxpayer: 2 C. If your tax residence is other than Colorado, you must fill out section B and submit to BIR your completed application in accordance with the procedures and deadlines outlined in this application form. You may submit this application, but you may not be able to file your taxes online or by mail the first year. Qty of Taxpayer: 2 You will be assessed any applicable registration fees, income tax levy (if any), and an annual tax assessment in full if you fail to meet any of the eligibility requirements provided for by sections A and B and if your U.S. tax residence on the date of registration is not Colorado. You are not eligible for an assessment if you filed under the provisions of Sections A, B, or C of this form or if you applied for a registration for an economic group to which you are not a member. Qty of Taxpayer: 2 Qty of Taxpayer: 2 C. If you are married, filing jointly, and married to a nonresident alien (either the spouse or a nonresident) who received compensation for services in Colorado in 2025 (i.e.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1902 bir form 2025