Music, welcome to our 80c news today. - The topic is nothing and a common mistake: late bir registration. - Veronica is seen again, of course, on a Facebook page. - She is starting a contact number for nag register service bir, but it costs 10,000 pesos or 20,000 pesos in Sunnyland penalty. - If not registered, imagine the deepest energy starting and business magnate in Hagen Kaitlyn Poobah Department registered CBR, so it is not late. - McGregor starts a BIR, okay so good, important young revenue regulation 7 2012 eternal human in your prototype prototype. - Namely broken attend a detention bio in November 2018 at Nandita bush-era incorporate RR 7 2012 commencement of business and avocado mousse. - For security, we must start the commencement of business in the case of the pursuit of business or practice of profession. - It shall be required from the day when the first sale transaction occurred or within 30 calendar days from the issuance of a mayor's permit professional tax receipt by LDU or certificate of registration. - It should be the SEC Securities and Exchange Commission, whichever comes earlier. - Some other injury topics include Adama sobbing Caillou, late Nana registers a BIR that pod for the first sale of a power transaction. - Marijuana bantha commencement of business. - It is important to register before sailing to Africa for services registration muna pasa DTI SEC LGU Barangay. - Including for the Bureau of Internal Revenue before poema Benton and goods or services no ok porque annamund made from getting your mayor's permit for professional tax receipt. - In the case of professionals practicing their profession, the applicable point is PDR within 30 calendar days. - Within 30 calendar days, so in the post-hammering weekend in holiday Sapodilla topic building and 30 calendar days from getting your mayor's permit for PDR. - Within 30...

Award-winning PDF software

1905 bir Form: What You Should Know

BIR Form 1905 Form BIR Form 1905 is used to give notice to the taxpayer or the taxpayer's agent of a transfer of registration, whether a transfer is of a business or other entity. This notice should come into effect at the beginning of the 1st July 2019. BIR Form 1905 — Fill Out and Sign Printable PDF BIR Form 1905 may be used when a transfer of registration is required by the Federal Tax Administration or the Central Tax Service (CTS). However, this form may not be used when a transfer of registration is required by the local, state, or territorial taxing authority, because, in that case, an Agency Order to Register for Registration (CORR) is attached. There are many reasons for a change of registration which would require a notice of transfer to the taxpayer. These include, (1) the change in status from being an employee to a non-employee, (2) a change in the number of employees, (3) a change of ownership, (4) changes in the source of income, (5) a change in income or deductions, (6) a change in the business entity, or (7) changes in income or deductions without an impact to the taxpayer. To simplify matters, this form is primarily used for transfer of ownership for a firm, business, registration for incorporation of any entity, etc., on a new or amended BIR registration as described. However, it may be used to transfer registration of any business with IRS Form 8300 to any other registration on the same basis as all types of registration on E.O. 98/46 are transferred. The taxpayer is required to sign on the bottom of the page. However, if a transfer is required for the transfer of an employee without a change in status/status of the employer, the transfer should be done on the BIR Form 1040. For the same reason, the transfer notice should be signed on the same page as the BIR Form 1040. To save on the cost of sending the form, do not fill out the BIR Form 1040. The original BIR Form 1040 should be mailed.

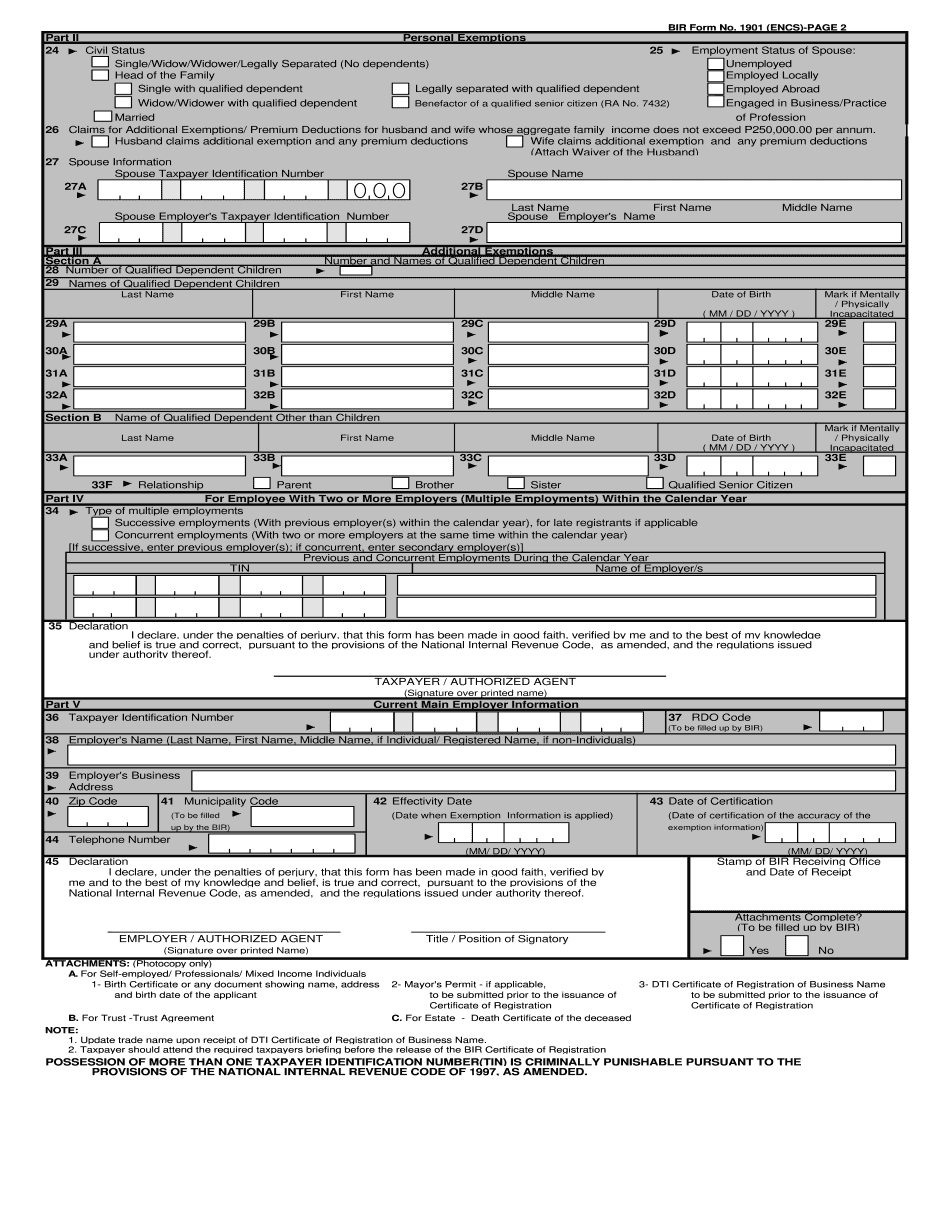

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1905 bir form