And honorable io, yes LM convened an IO am potala nothing. I regular Allah Ta'ala to superior form 1701 q humanik Bob. I had no income tax at NAPA biood eternam percentage stocks or non value-added tax from first quarter. Okay, Sharon will be the min impairs quarter okay. I know Eve in a purse water and purse quarter pole a January 1 maxi Simula at Matata Poznan March 31. He big Sabean un transaction no pry or January 1 in the Hassan a after May 31 in transaction a on B ring Kazama. Oh, we began morning three seconds ax 1, 2, 3 good allah muna set up nothing what I know 1701 at Sasha by an EOC mr. My Astro CPM numpad people up again para who it was a Maha taxpayer. A to let gonna go muhammad nam OU d and is the optional standard deduction. Now it was a lie limiting 1701 aha memorize a trial for the year support a year it being a young un 800 de la laguna 1000 no Holly Mouton near a require Hunan batas I a no Elena and Bolton yes correct cool. I block so Antonio night 2018 i oh no I yeah so I'm Gaga meeting you don't associate not in a number two and talk I quarter well again you know X Expo I'm hitting number toss I you know and you own poon third at port I'll again you know applicable answer doing saturd amended return Milligan an ex you know number of copies young neligan canang a civil on a man who not Apache the top was known pupunta ho cosas number 8 at eco cross out no sub number 8 I I own young boom may cross John Young hobby I business income graduated...

Award-winning PDF software

Bir 1701q 2025 Form: What You Should Know

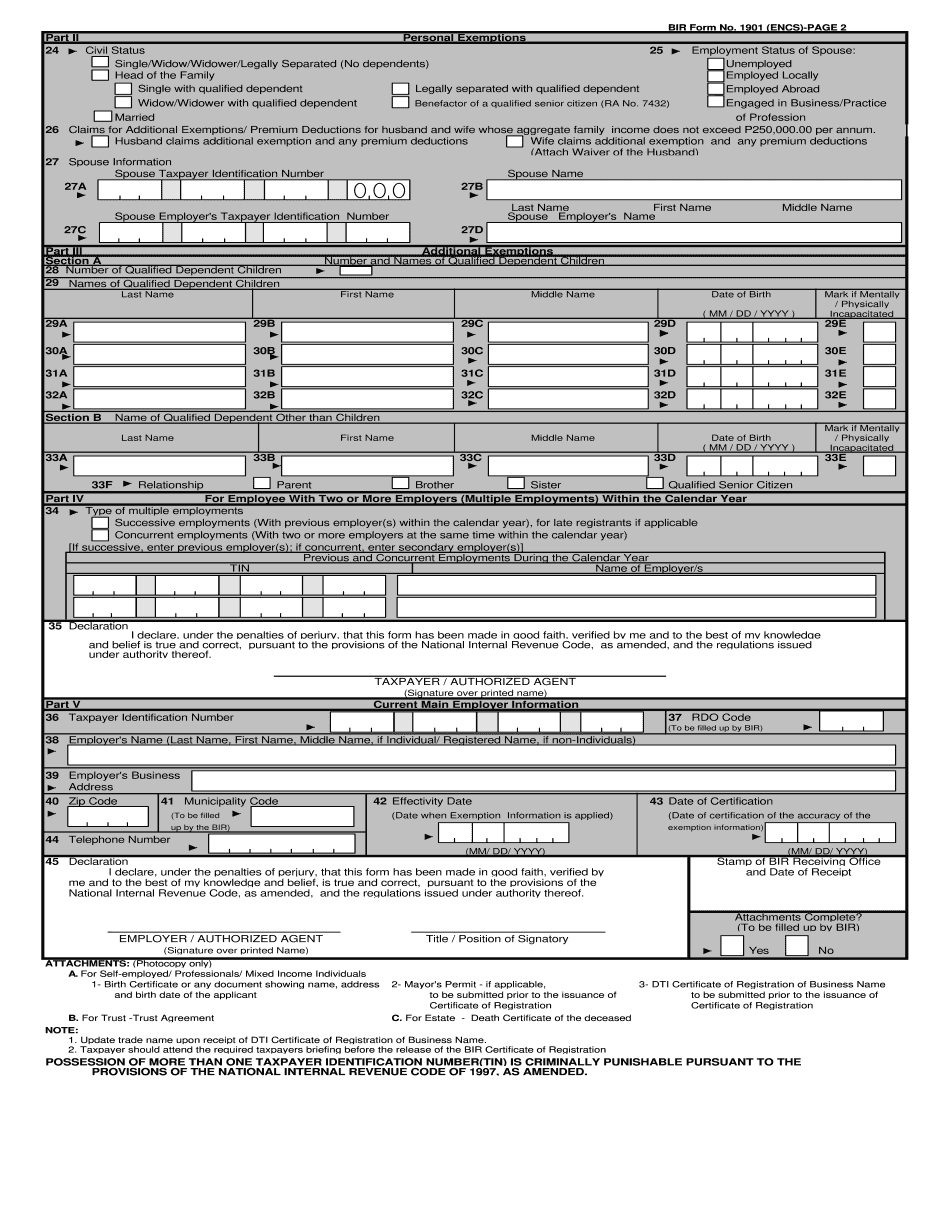

This page is only required when you need to report your income. You do not need to fill this form if your only earnings are: Business income is from a sole proprietorship, limited liability company or other business. Other business income is from business entities such as partnerships, sole proprietorship, etc. Capital gains can come from: Rent/mortgages/finance interest. Personal expenses, such as: Income that does not meet one of these requirements can be reported as self-employment income or as ordinary income. Income of up to 2,500 from your rental, mortgage or finance income, and you paid a qualified business expense (including a qualified business loan), such as a loan to pay for expenses. Income of up to 2,500 from your personal expenses and you paid a qualified business expense. Use this form to report income which you had earned in the past and which you expect to earn in the future: Form SSA-1099, 1099-INT, 1099-R, 1099-Q or T1045. Form 1039 is only available from the IRS; you can get Form 1039-INT if you have earned over 600 this year. You can get Form 1040NR if your earned income is over 400 from all source sources. To get the form for this year, select the line that says Earned income is 600 or more. BIR Form 1701Q is only available to the US residents of Puerto Rico and the U.S. Virgin Islands. Enter income from Puerto Rico and US Virgin Islands in the US source boxes! BIR Form 1701Q is also available for Canadians, British Columbia residents, South Korean residents or Taiwanese residents. Check your tax bracket. A Taxable Income Rate is tax rates that you pay on your income as indicated in Table 1. Use this to find out if your income should be filed on your Federal Tax Return, and if so, what to enter. For those who have to file a State/State Tax Return, enter income from: You can check if you have to file (or will file) a Tax Return using this form: Form TD1, 2102, 5498 or T1066. If your income is taxable, enter it in the Taxable Income Column of these forms.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Bir form 1701q 2025