Award-winning PDF software

Bir 1905 etis-1 only Form: What You Should Know

We can help your company to do this quickly and easily because we provide you with one of the best information technology solution. By using the service, you do not need any software. All you need to do is click one of the options below. 2 BIR FORM 1905 (2017) Fill Online, Printable, Fillable 2 BIR FORM 1905 (2018) Fill Online, Printable, Fillable 2 BIR FORM 1905 (2018) Fill Online, Printable, Fillable 2 BIR FORM 1905 (2017) Fill Online, Printable, Fillable 2 BIR FORM 1905 (2018) Fill Online, Printable, Fillable You'll need to use this form in some cases. It is important to update your information according to the applicable law by filling it out. Please remember that it will take you 10 days to process your information. You will only need to use this form if there is more than one person involved with your business. There was a recent ruling that you are only allowed to include each employee in the tax calculation. You can make sure that you do not go back in time and add them all. There are other laws that apply in this case, so before proceeding please check if they apply to your situation as well. It will help BIR to process everything quicker. The BIR Form 1905 is the primary form that is used to transfer information from the DO NOT RESUBMIT, NO FEE, and RESTRICTED TO CIVILIAN PERSONNEL (RCP) to the new employer. It is required for all employees who are no longer in employment (NRG/RCP), as well as certain RSC persons/employees hired by the new employer. Please note that employees in an agency position are exempt. The BIR has been working hard to ensure that this form is complete and accurate. In case you have any questions or want help processing this form, please contact us on our toll-free support line: To prepare and fill up this form online, click the following link and then click “PASTE AND SIGN” You will be able to upload your resume/ CV/ Cover Letter of any kind, fill out the required fields and then click “SIGN” button.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

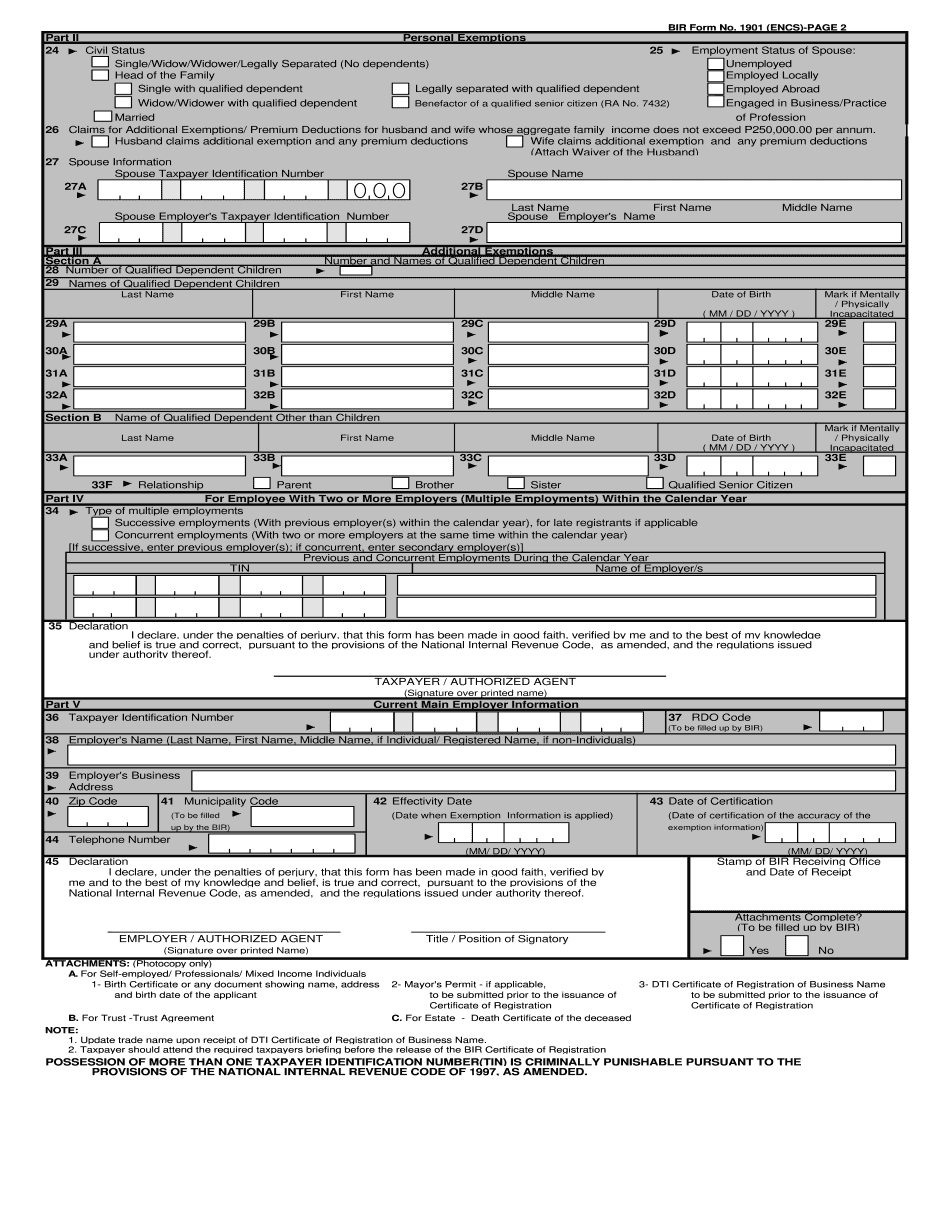

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.