You good day everyone and welcome to the first blog of my finish and the end of pinky. In this first episode of the finance doctor, I'm going to show you how to compute income tax return. Okay, before we start, let's begin with my disclaimer. Who am I? I'm not an accountant, I'm neither a bookkeeper. I'm a medical doctor by profession, so basically I know what I need to know. Also, I'm a registered financial important our planner and a steak dinner. You can know more about me in my mom's sell tickets. Now let's start. First, let me ask you this question: Why do you need to know how to compute your taxes? Let me answer this. In the Philippines, they said nobody goes to jail due to tax evasion. Is it true? Actually, it's true until 2012 when we had our first case of tax evasion. No, she was sentenced to jail. It's a case of missing or a container versus people, people of the Philippines. Rayon, she was sentenced to two to four years imprisonment. And you know, when you reason and defend, she does not know that her accountant is not filing the right tax. So maybe most of you here in the new defense, if everyone, because I love me, I have an accountant. Demand, so I don't know if she's fighting Maurice, find the right tax. But the problem is, the BIR said it is called the willful blindness top taking. Maybe say in medical terms, captain of the ship. It also means that it's your fault, not your accountant's fault. So if your defense is my hunted, the monopoly think again. Okay, so the pitfall of doctors, there are doctors think they are not liable for the mistakes of their accountants....

Award-winning PDF software

Bir 1701 excel 2025 Form: What You Should Know

See the link 2 BIR Form 1701 Excel 2018, Fill in, Sign, Print Get the 2025 BIR form 1701 Excel Form with detailed and easy to use instructions. Create a new 2018 BIR Form 1701 Excel download I have received a lot of comments saying that they want a “free” form, but they don't want to pay any fees to file it online. I'm guessing they have an Online Filing of EEA Returns with the free version. This gives free access to the BIR form 1701, which is free to file! Form 1701 – 2025 I would recommend that you Make the decision based on your current situation, not on an “anytime” offer. What if you are not sure? I would suggest checking with to make sure that you are filing for the correct type of company. For those with a full-time position where their employer is responsible for income tax — a self-employed employee or Self-employed employee is the most likely employer to be responsible for income tax. Do you want to work as a consultant or as a salesperson? This is probably the first time you have used a new technology. Is the information about you correct? This is the first time you use an electronic filing system. You may have to make some changes after checking your data. Do you wish to submit a paper version of the paper form? This is the first time that you use a tax form that is electronically filed.

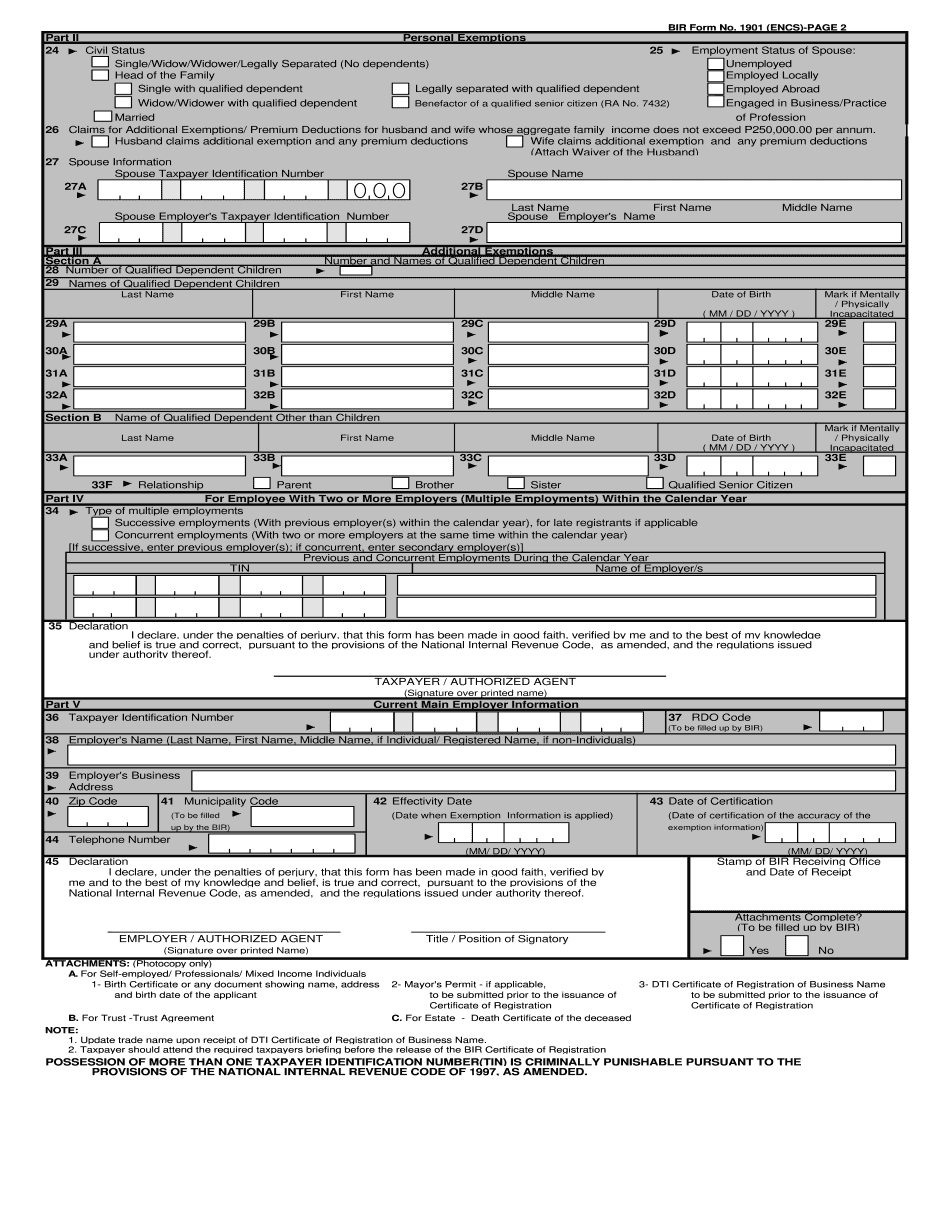

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Bir form 1701 excel 2025