Music, we have to do this now. Just a few more steps. Guess who's a certified professional? Self-employed? Still need two sworn declarations to complete your tax requirements. Applause! They look tired. Yet think, this day's been very taxing. Really a pun! But the sworn declaration is a really important requirement. Why? What does that a sworn declaration of independence love and wish? But no, it's really just a document that declares if you have just one source of income or many sources of income. So, what do I need that for? The important thing to know is that when you complete the requirement as an online tutor for Bebo, you'll be subject to % income tax, zero taxes. Oh my G! If you earn 250,000 pesos or less gross income in a year, oh well, that's still okay. Yes, also if you don't even get a 10% deduction, with a chance to be penalized by the BIR? Penalized? No, it's the final requirement. Honestly, that's what you said last time. I'm done. Actually, no, you're not. Just one more little step. Come on, can we do this some other time? We're already here, just get it done. I'm so tired. I'll treat you to cake afterwards, okay? So, what do I have to do? You need to download one of two forms, Annex B1 for freelancers earning income from many sources, or Annex B2 if you only have one pair or source of income, like if your income only comes from Bebo, for example. Wait, let me do it this time. To download, check out the links, and then just what she said next. Fill out the forms and then have them notarized. Where do I get a notary? Just any notary public? And that's it. Just submit the...

Award-winning PDF software

Bir 1904 latest version Form: What You Should Know

Download BIRD to fill up the completed form No need to buy expensive copy machines, we've got you covered with the following options: View PDF format online at this location PDF, PDF, PDF, PDF. No installation required PDF with BIR form and BIR Form 1848 printable forms available online at this location. No additional costs if you print each one and save as PDF. View PDF format online at this location PDF, PDF, PDF, PDF. You don't need to install software, just go to Chub, and sign up instantly and for free. View PDF format online at this location PDF, PDF, PDF, PDF. You don't need to install software, just go to Chub, and sign up instantly and for free. View PDF format online at this location PDF, PDF, PDF, PDF. You don't need to install software, just go to Chub, and sign up instantly and for free. Download the PDF forms and files required to fill out the form. How to fill out the BIR Form No. 0217. No need to print, just go to BIR, and fill out the form online at the link below. No additional costs for additional copies. Click on PDF for additional copies of the completed form. Click on PDF for additional copies of the completed form. PDF for multiple copies View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF View, edit the PDF format allows you to print as many as you need to fill out the form. How to fill out the BIR Form No. 0217. No need to fill out the form, just go to BIR and fill out the form online. No additional costs for additional copies (just click the link below for the additional copies). Click on PDF for additional copies of the completed form.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Bir 1901, steer clear of blunders along with furnish it in a timely manner:

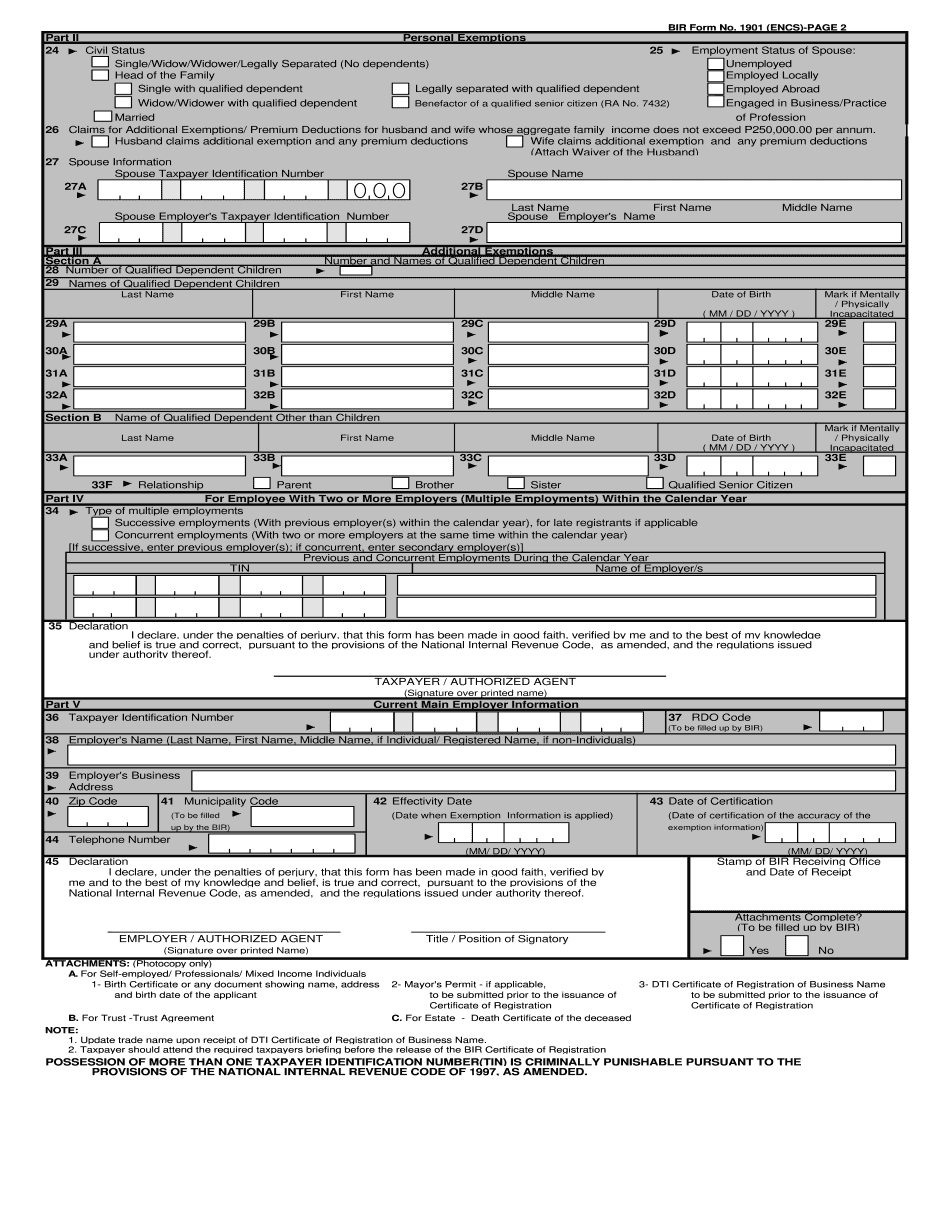

How to complete any Form Bir 1901 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Bir 1901 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Bir 1901 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Bir form 1904 latest version