Award-winning PDF software

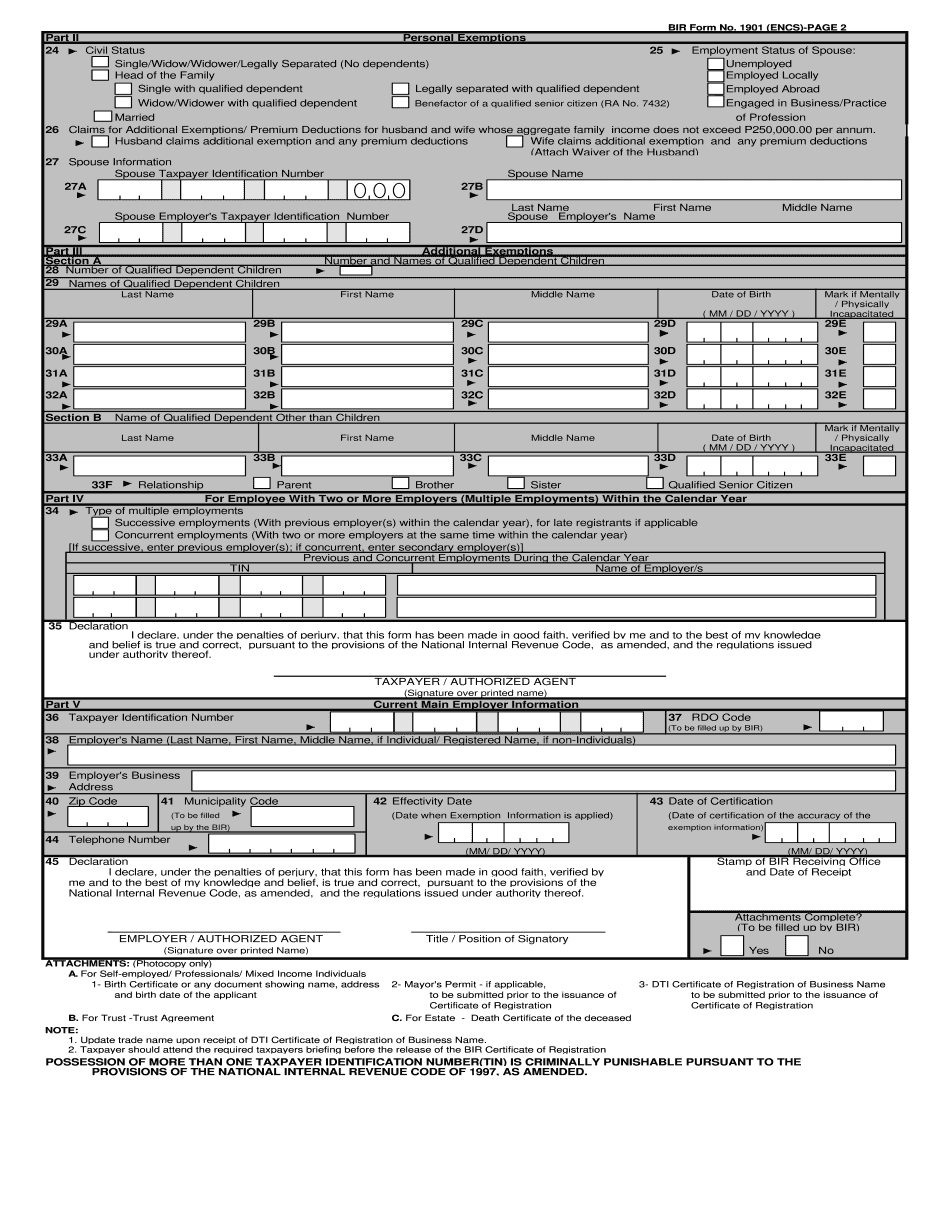

Application forms - bureau of internal revenue

Inspector General Office of the Inspector General Washington, 20560 Re: Contract No. 4A3-00017-11C-GX-0829 Date: December 21, 2012 Dear Sir: I was recently requested by my Office of Public Affairs and Public Accountability to investigate the contracting activities of the Department of Energy (DOE). The investigation is for the period of March 24, 2012, through December 21, 2012. The scope of the investigation is to ascertain the following: (a) whether DOE's contract solicitation and award practices were proper in relation to the awarding of the Energy Star Program contract to AEC. (b) whether DOE's solicitation and award practices regarding the award of the Energy Star Program Contract to AEC were proper in relation to the solicitation of bids in accordance with the Federal Acquisition Regulation (FAR) and other procurement regulations. In my investigation I took the following actions: Consulted with AEC and its executives; Disclosed evidence of questionable and potentially illegal conduct to the American Bar Association (ABA) and the.

Fillable online lawphil bir 1901 form download fax email print

It takes about 5 minutes to fill out the form so don't be afraid to use this one. To begin, click the button with the check in box above for “I agree to abide by the applicable Federal Tax principles in accordance with regulations to be issued later”. Next, check the box in the top right corner, click “I” and hit the “next button”. The next page has the following fields: The title of the application: The address of the address of the business: The name of the business: The type of business you want to apply: The total amount of profits to be reported (amounts to be reported depend on where you own and operate the business): Check here ONLY if you are filing tax returns for the business. The total amount of income (if any): For individuals: For trusts, Estates, and other entities: All the statements below must be on your sheet. Please note that there are several.

Application for registration bir form no. - city of san

For Individuals, to be filled in by the employer of the individual. The BIR Form No. 1901 may be obtained online, and a new copy is filed with your most recent TIN at the time of filing. (See IRS Publication 550, Employer's Tax Guide.) If Your Taxpayer Identification Number and Address Are Different from the Taxpayer Information Used to File the IRS Form (B2, B4, B5), You Must File a Copy of the BIR in Your Own Name If your taxpayer Identification Number and residential address on Form W-2 do not match the IRS address (B-0111) on the Form 2555, you must use the BIR Form No. 1901. This will reduce the risk that you may become aware of filing a Form 2555, and the possibility of having that form rejected by the IRS or, even worse, receiving a Tax Lien Notice. You may want to refer to IRS Publication 929 and.

Bir-form-1901.pdf - official gazette

I also declare, in response to the “Who are you” question, that I am at least 21 years of age. I agree and promise that if contacted by a lawyer for services, I will assist and cooperate with such attorney's representation for which fees are not to exceed a reasonable amount. By signing the “Declaration of Marriage” below and signing this form, I authorize my signature to be notarized with both myself and my parent's signature to the following effect. I hereby represent that if I am contacted for services by a lawyer for services, I will assist in any representation and/or representation for which service fees are not to exceed a reasonable amount and/or will provide my signature to this declaration in any such representation. I take this Declaration of Marriage form under the penalties of perjury that I am able to sign my signature. By signing.

A guide to bir form 1901 - filipiknow

Complete Form 1901. This document will show that the new self-employment income is taxable. 2. Submit a copy of the required tax return from the other BIR, Form 3115. 3. Submit the other documents required to register as a mixed-income business to the New Business Registrant. These are listed in the table below. The other documents must have the same due date as the Form 3115. Please make sure that all the necessary forms are on file for your period to be allowed to pay your self-employment tax. 4. Mail the completed items to the New Business Registrar. 5. After six months from the date of closing, the new self-employment tax returns will be processed and mailed to you. If you received notice of late filing of your Form 3115, use the “late filing” number, or any other date on the IRS Notice of Electronic Filing. If the tax.