Award-winning PDF software

BIR, or the Bureau of Internal Revenue, is responsible for collecting internal revenue taxes, enforcing penalties, and most fines related to taxes and the tax processes. The Bir Form 1901 is also known as an application for registering self-employed individuals with mixed-income.

What is the purpose of the Bir Form 1901?

The document has to be filled out by self-employed individuals or those with mixed-incomes who are either already working, just starting to work, or adding a new branch to their business. All of this has to be registered. It’s important to remember that the template must be filled out before starting a new business or paying any respective taxes.

How do I fill out a Bir Form 1901?

Newbies to business, might not know where to start when it comes to filling out important tax documents like this one. Here’s a brief guide on how to complete the template:

- Open it online in the PDF editor.

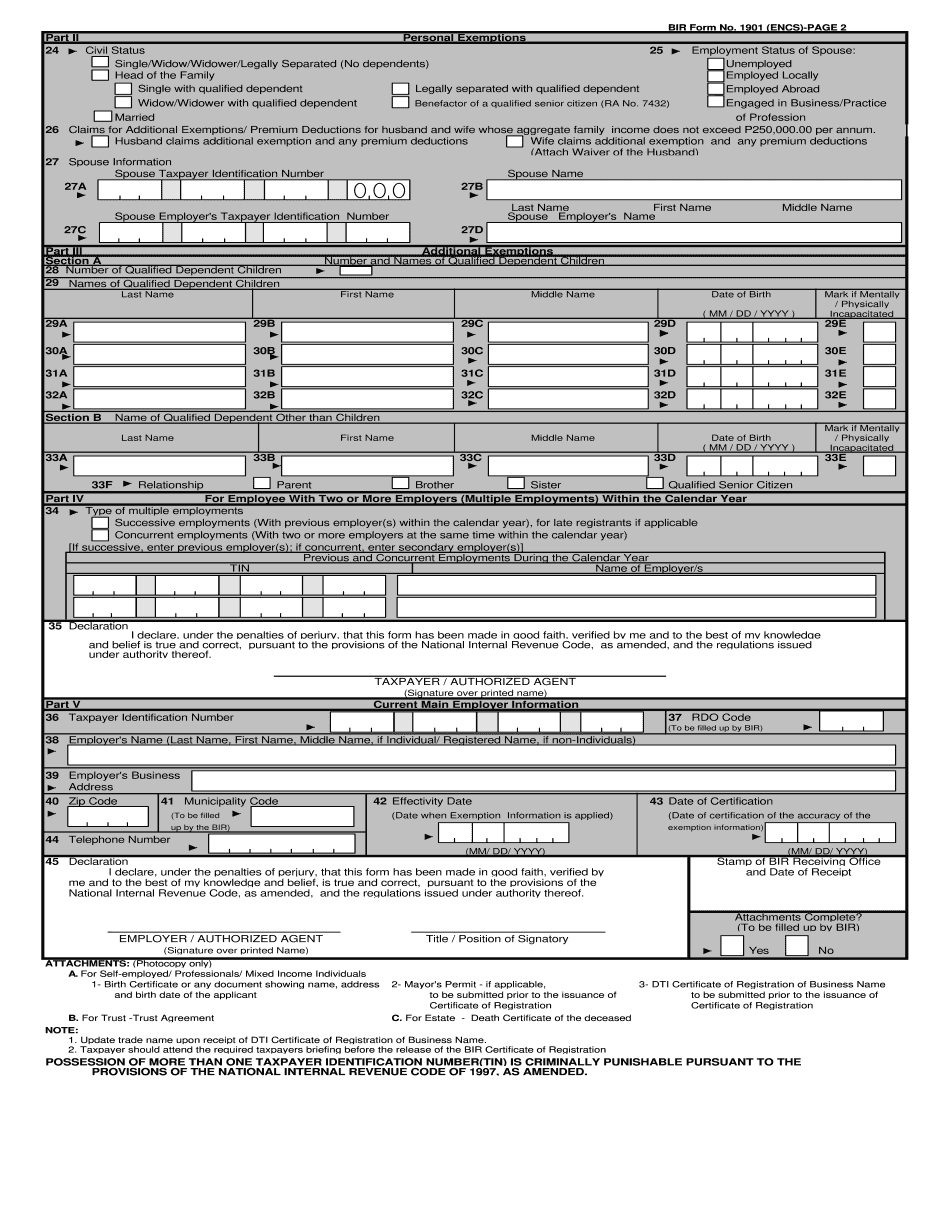

- Add your civil status and the information regarding your spouse (Part II).

- Enter the required information about the authorized representative (Part III).

- Complete Part IV (for those who have changed two or more employers within one year) and put your signature.

- Part V must be completed with the employer’s information and also requires a signature.

Now, simply download, print, or share your document.