Welcome back to our Channel guys so for today's video form 1901 bir form 1901 so this form is to be accomplished by self-employed and mixed income individuals Estates trusts doing or just starting a business or opening a new Branch for registration guys filing deities on or before commencement of new business or before payment of any tax due or before filing a return forms a bir office download online fill up applicable white spaces Marco appropriate boxes with an XX video form 1901 store number one is branch office foreign number 12 mothers maiden name number 13 father's name number 14 citizenship number 15 other citizenship Hindi applicable number 16 local residence address number 17 business address number 18 foreign address Co applicable number 19 to be filled up by vir employee number 20 purpose of teen application number 21 identification details so dito guys birth certificate passport driver's license or any identification issued by an authorized government body number 22 contact type and contact number number 23 email address item number 42 is having jurisdiction over the head office or branch office requirements a video foreign.

PDF editing your way

Complete or edit your bir form 1901 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 1901 bir form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your bir form 1901 pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your bir 1901 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Bir 1901

About Form Bir 1901

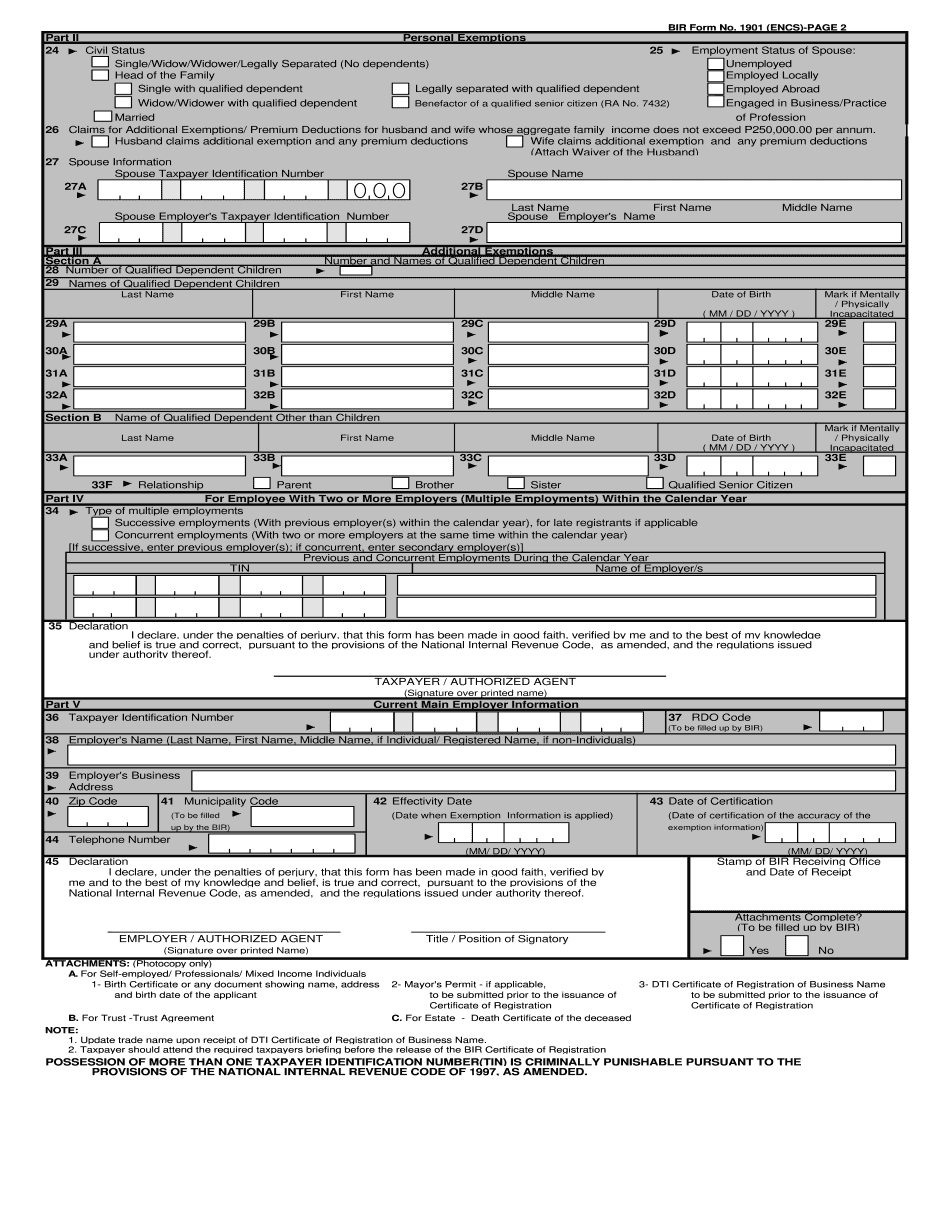

Form Bir 1901 is a document required by the Bureau of Internal Revenue (BIR) in the Philippines for individuals who are self-employed and engaged in business or profession, or those who are practicing their profession as a single proprietor. This form is also known as the "Application for Registration for Self-Employed and Mixed-Income Individuals, Estates/Trusts", which serves as their registration with the BIR. The BIR uses this form to determine the tax obligations and responsibilities of the individual or the single proprietor. The form requires the applicant to provide personal information, business details, and other relevant information necessary for taxation purposes. Overall, Form Bir 1901 is necessary for individuals who are self-employed and engaged in business or profession, or those who are practicing their profession as a single proprietor to comply with the tax registration requirements mandated by the BIR.

What Is Bir Form 1901?

The Bir Form 1901 or the Application for Registration for Self-Employed and Mixed Income Individuals, Estates/Trusts is a document used for the registration of self-employed entrepreneurs and individuals with mixed income. It is also important for estates and trusts with start-up business.

To avoid difficulties with the document preparation you may use an online Bir Form 1901. Open the digital sample, fill out the required data, add your signature by typing, drawing or uploading it, and send the file to the recipient via email, fax or sms. If necessary, you may print out the fillable blank and complete it by hand.

How to Organize Data for the Form 1901?

Open the PDF template from any internet-connected device. Type the required information into fillable fields. Pay attention to the guideline below to clarify some points.

- Read all the field labels.

- Start from the ‘Personal Exemptions’ block.

- Mark appropriate boxes.

- Indicate details pertaining to your spouse.

- Specify additional exemptions in Part III.

- Employees with two or more employers have to complete Part IV of the application.

- Then it is required to add a signature.

- The last block concerns the employer’s information and has to be signed by them.

Once the document is completed, download it to your device and share with involved individuals.

Note that the form has to be prepared on or before the new business commencement, or before tax payment.

Online choices enable you to prepare your document management and improve the efficiency of one's workflow. Go along with the quick manual in an effort to entire Form Bir 1901, stay clear of errors and furnish it in a well timed manner:

How to finish a Form 1901?

- On the website with all the type, click Launch Now and pass towards editor.

- Use the clues to fill out the pertinent fields.

- Include your own facts and get in touch with info.

- Make absolutely sure that you just enter right facts and figures in correct fields.

- Carefully check out the content belonging to the sort too as grammar and spelling.

- Refer to support segment if you've got any issues or deal with our Support workforce.

- Put an electronic signature on the Form Bir 1901 with all the aid of Indication Device.

- Once the form is concluded, push Completed.

- Distribute the ready type via e mail or fax, print it out or save on your own machine.

PDF editor lets you to definitely make variations in your Form Bir 1901 from any web connected equipment, customize it according to your preferences, indicator it electronically and distribute in various strategies.

What people say about us

It's a good idea to distribute forms on the web

Video instructions and help with filling out and completing Form Bir 1901